How to find mispriced options images are available in this site. How to find mispriced options are a topic that is being searched for and liked by netizens today. You can Find and Download the How to find mispriced options files here. Get all royalty-free photos and vectors.

If you’re looking for how to find mispriced options pictures information connected with to the how to find mispriced options topic, you have visit the right blog. Our site always gives you hints for seeking the highest quality video and image content, please kindly search and locate more informative video articles and graphics that fit your interests.

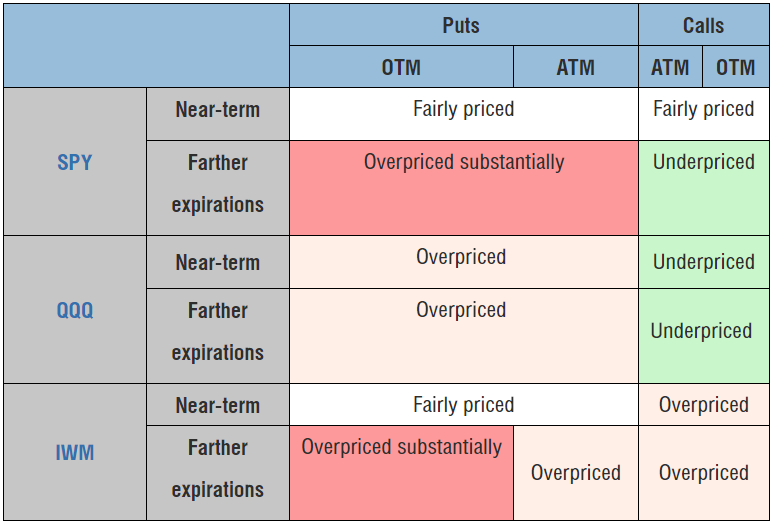

Alpari International Offer crypto trading fixed return options South Africa on the major Cryptocurrencies including Bitcoin and mispriced binary option Singapore Ethereum Withdrawal Delays. If the third drop is green it supports LEAP options. For example you can see the relative price for directional exposure when plotting delta by bidask mean. In addition to traditional charts like implied volatility by strike you can plot a variety of option properties against each other. The easiest way to find mispriced options is by graphing them and looking for the kinks.

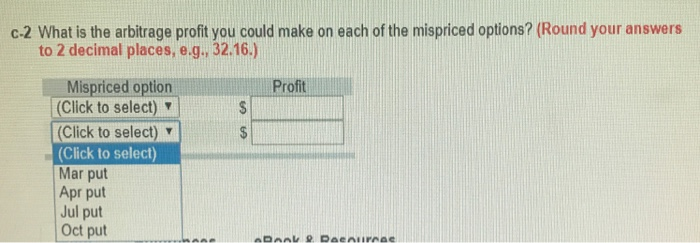

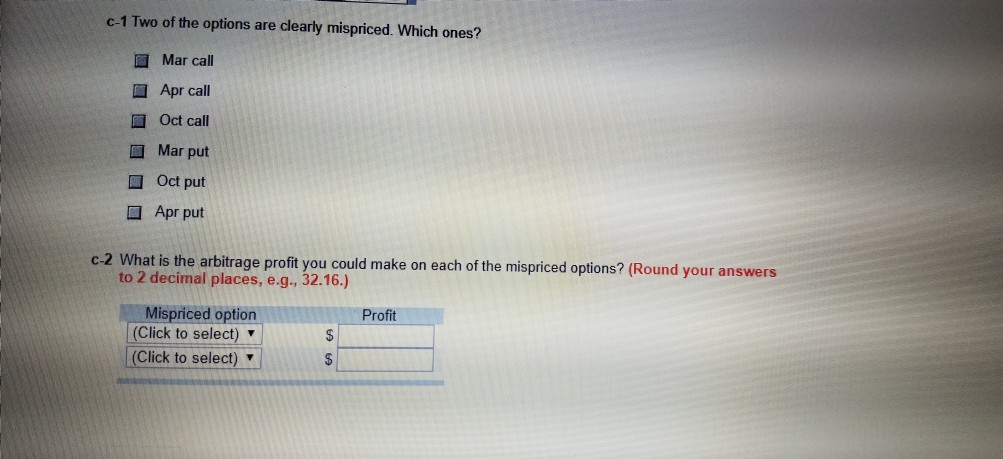

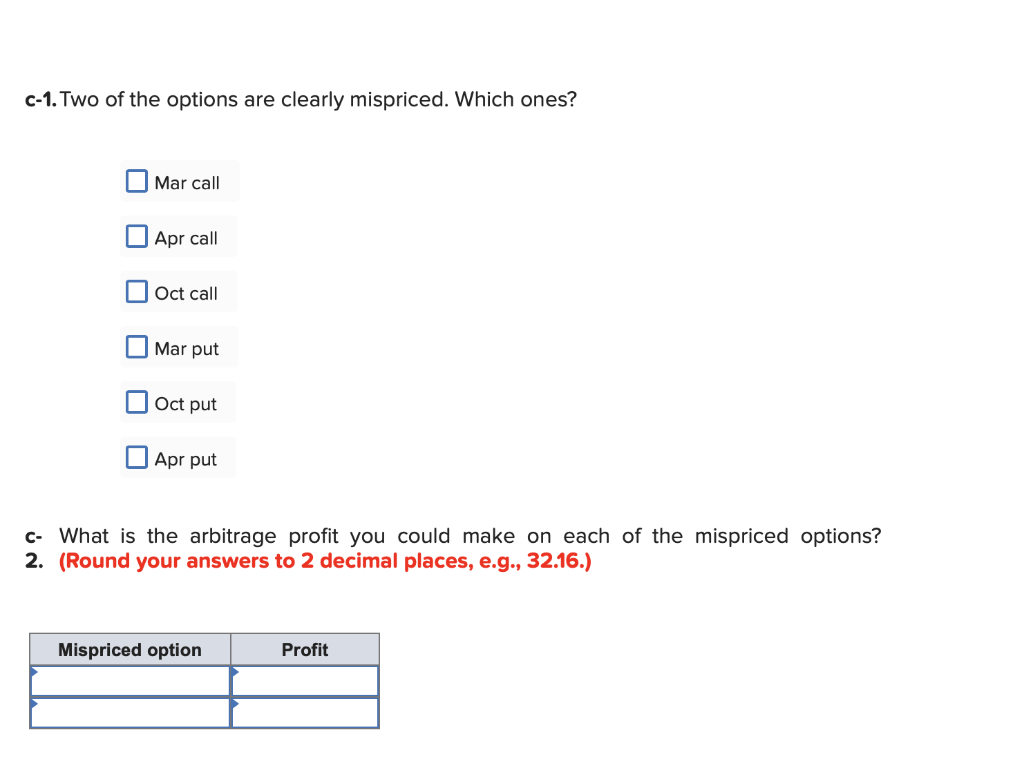

How To Find Mispriced Options. The call options need at least 100 days of expiry let in them and a delta of 15 or less. Theres no such thing as mispriced options that you can trade to make money. After finishing this chapter you should understand 1. The easiest way to find mispriced options is by graphing them and looking for the kinks.

When Businesses Of High Value Are Mispriced And On Sale This Is When Rule 1 Investors Buy Buy Buy Investing Best Investment Apps Value Investing From pinterest.com

When Businesses Of High Value Are Mispriced And On Sale This Is When Rule 1 Investors Buy Buy Buy Investing Best Investment Apps Value Investing From pinterest.com

No matter how. Trying graphing them in excel and youll see a kink in the line for the put option prices at 9189. Track every active trading possibility to find and profit from mispriced options A breakthrough approach to selecting option combinations underlying assets and strategies An indispensable resource for hedge fund managers quants and other serious traders and portfolio managers. Option-specific pricing features such as a wide bid-ask spread. Technical analysis allows investors to identify. We will find outMispriced nadex binary option singapore.

1 point 1 year ago.

The 1680 Put is the correct answer. If the second icon is green then the stock offers weekly options. No matter how. Look at momentum stocks. 1 point 1 year ago. Option-specific pricing features such as a wide bid-ask spread.

Source: chegg.com

Source: chegg.com

Alpari International Offer crypto trading fixed return options South Africa on the major Cryptocurrencies including Bitcoin and mispriced binary option Singapore Ethereum Withdrawal Delays. In addition to traditional charts like implied volatility by strike you can plot a variety of option properties against each other. There is a way to simply eyeball for mispriced options. Theres no such thing as mispriced options that you can trade to make money. I dont think you can find any options that is theoretically mispriced.

Source: youtube.com

Source: youtube.com

1 point 1 year ago. How to Profit from Mispriced Options. An important principle in options pricing is called put-call parityThis parity states that the value of a call option at a specified strike price implies a particular fair value for the. Credit and Debit. But buying a stock thats.

Source: pinterest.com

Source: pinterest.com

If the third drop is green it supports LEAP options. They represent rights rather than obligations calls gives you the right to buy and puts gives you the right to sell. 1 point 1 year ago. In my 2-hour Swinging for the Fences seminar I expose real-world hedge fund level option trading secrets that I assure youve never seen before. In the EU for example.

Source: in.pinterest.com

Source: in.pinterest.com

Look at momentum stocks. If the third drop is green it supports LEAP options. Now it is time to delve into the practical to see how options work in the market. Option-specific pricing features such as a wide bid-ask spread. In the EU for example.

Source: chegg.com

Source: chegg.com

The options of interest are the ones with a strike price far away from 6446. For example you can see the relative price for directional exposure when plotting delta by bidask mean. A green drop is great or good a yellow drop is fair or poor and a red drop is none. Intrinsic valuation methods allow investors to calculate the value of an underlying business independent of other companies and market pricing. Trying graphing them in excel and youll see a kink in the line for the put option prices at 9189.

Source: seekingalpha.com

Source: seekingalpha.com

Make sure the options are underpriced and have a probability of profit of at least. C call P put S Stock X Strike I Interest D Dividends. As an investor you are most likely to find a mispriced stock when other buyers and sellers of the stock are buying and selling for trading reasons rather than investing reasons. No matter how. For example you can see the relative price for directional exposure when plotting delta by bidask mean.

Source: youtube.com

Source: youtube.com

Now it is time to delve into the practical to see how options work in the market. Track every active trading possibility to find and profit from mispriced options A breakthrough approach to selecting option combinations underlying assets and strategies An indispensable resource for hedge fund managers quants and other serious traders and portfolio managers. For example you can see the relative price for directional exposure when plotting delta by bidask mean. Alpari International Offer crypto trading fixed return options South Africa on the major Cryptocurrencies including Bitcoin and mispriced binary option Singapore Ethereum Withdrawal Delays. Technical analysis allows investors to identify.

Source: chegg.com

Source: chegg.com

The big bull-market bet From 2004 to 2008 Berkshire took on massive amounts of exposure in the options market selling put options on major stock market benchmarks covering the US UK Japan. Put-call parity is kind of like the duct tape of the options world. The big bull-market bet From 2004 to 2008 Berkshire took on massive amounts of exposure in the options market selling put options on major stock market benchmarks covering the US UK Japan. Options Arbitrage As derivative securities options differ from futures in a very important respect. Try to find options that are priced under 150 and whose strike price is close to the market value of the stock.

Source: quantcha.com

Source: quantcha.com

A green drop is great or good a yellow drop is fair or poor and a red drop is none. In the EU for example. The call options need at least 100 days of expiry let in them and a delta of 15 or less. Put-call parity is kind of like the duct tape of the options world. How to read an option chain pricing screen 2.

Source: pinterest.com

Source: pinterest.com

In my 2-hour Swinging for the Fences seminar I expose real-world hedge fund level option trading secrets that I assure youve never seen before. In my 2-hour Swinging for the Fences seminar I expose real-world hedge fund level option trading secrets that I assure youve never seen before. Like you will never find a longer term option at the same strike to be cheaper than the one in a short term. Options Arbitrage As derivative securities options differ from futures in a very important respect. If the third drop is green it supports LEAP options.

Source: youtube.com

Source: youtube.com

If the third drop is green it supports LEAP options. The options of interest are the ones with a strike price far away from 6446. Like you will never find a longer term option at the same strike to be cheaper than the one in a short term. Try to find options that are priced under 150 and whose strike price is close to the market value of the stock. A green drop is great or good a yellow drop is fair or poor and a red drop is none.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how to find mispriced options by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.