Lumber futures etf images are ready. Lumber futures etf are a topic that is being searched for and liked by netizens now. You can Download the Lumber futures etf files here. Find and Download all royalty-free vectors.

If you’re searching for lumber futures etf pictures information linked to the lumber futures etf keyword, you have pay a visit to the right blog. Our site always provides you with suggestions for refferencing the highest quality video and image content, please kindly surf and find more informative video articles and graphics that fit your interests.

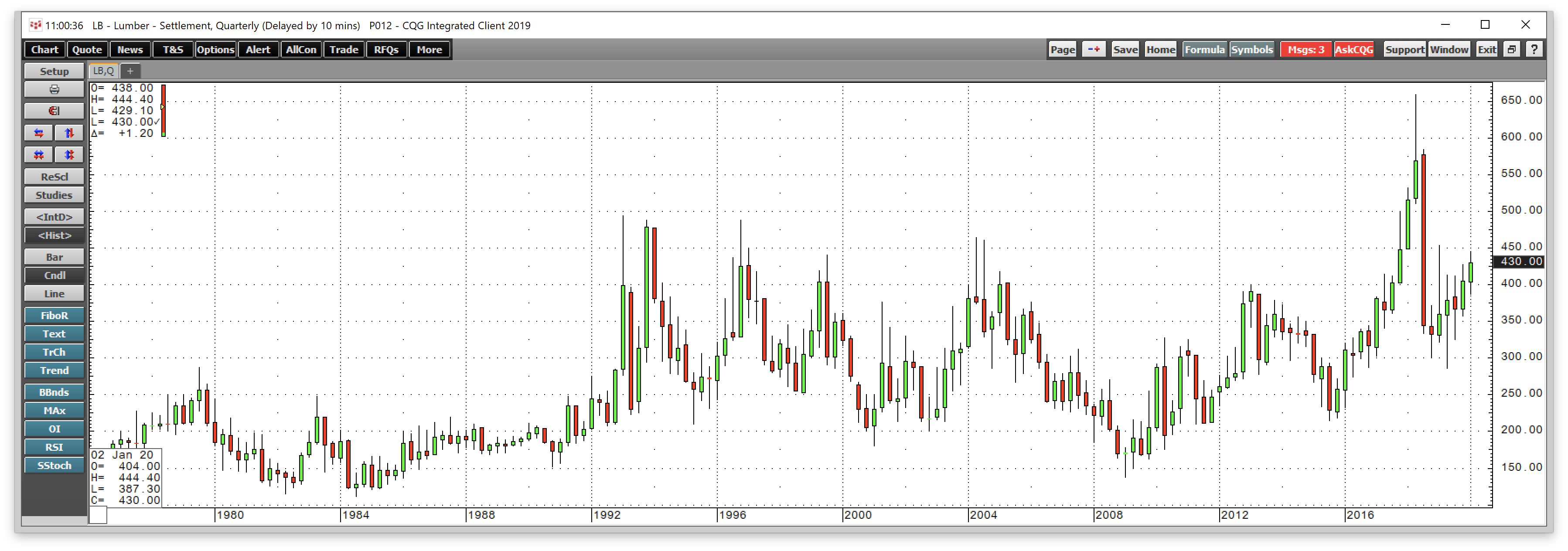

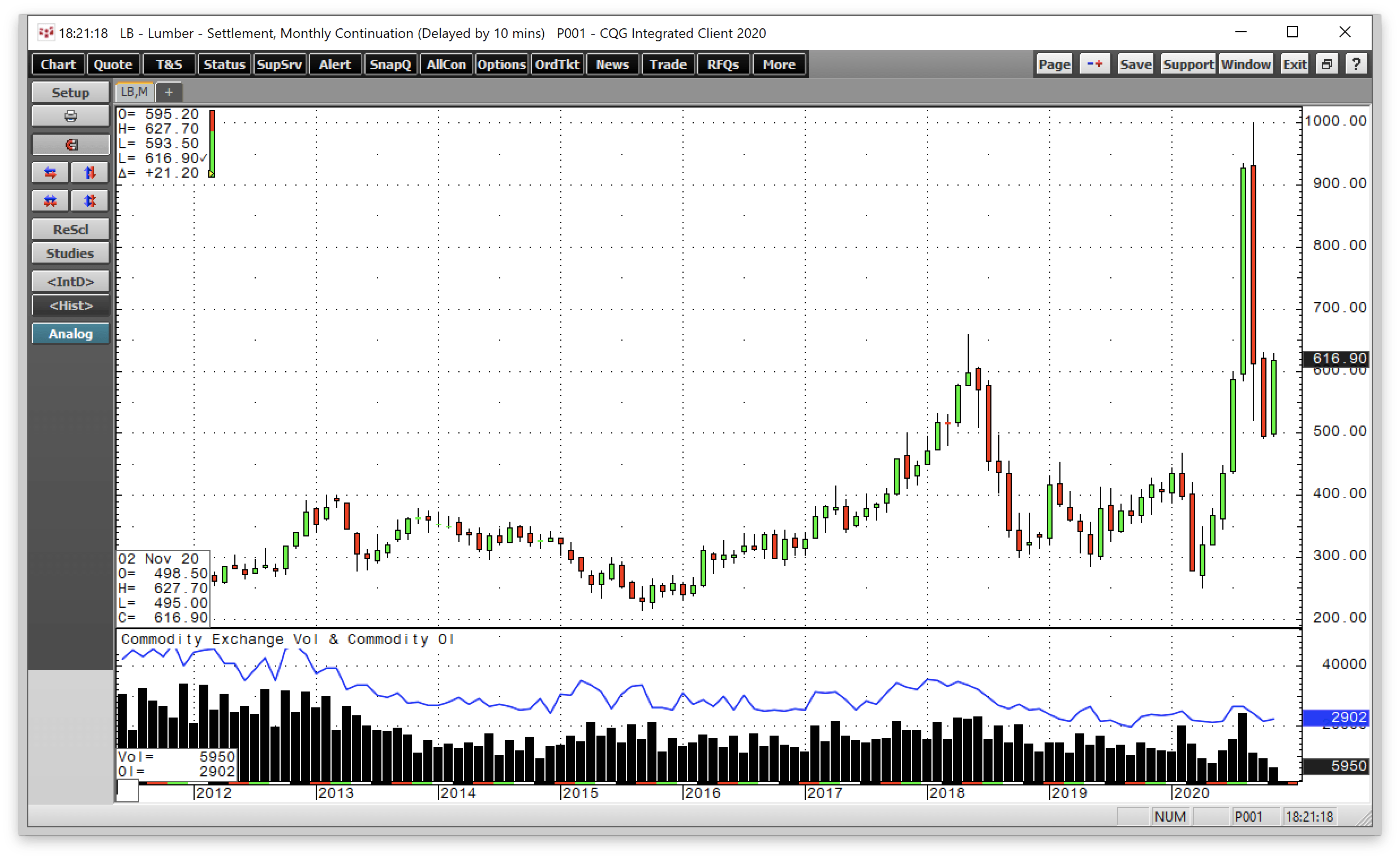

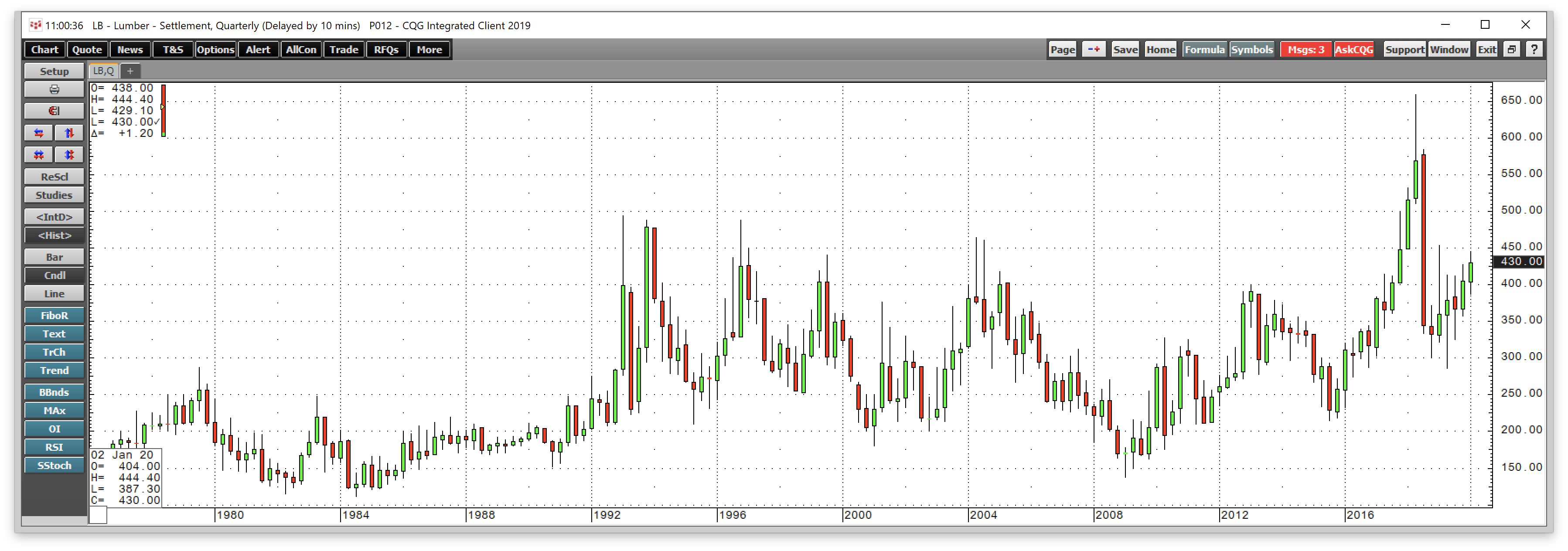

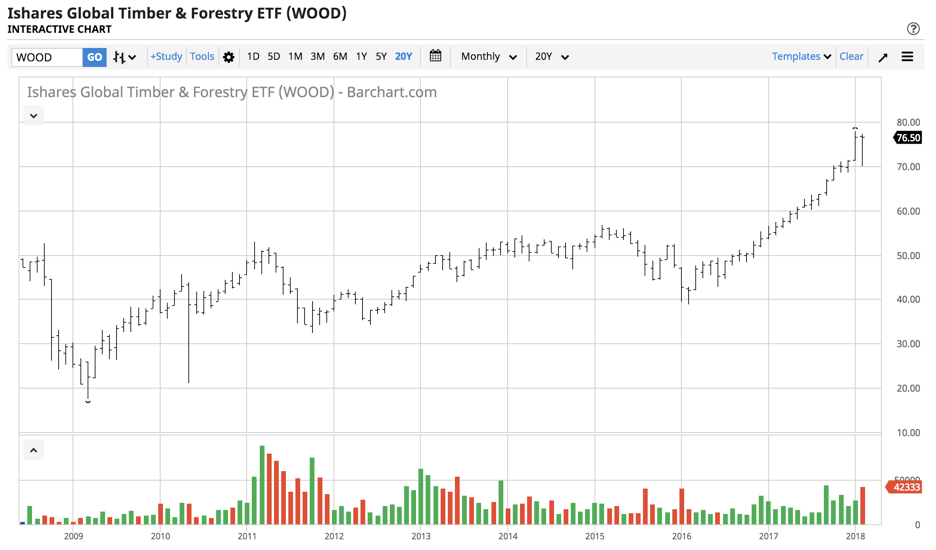

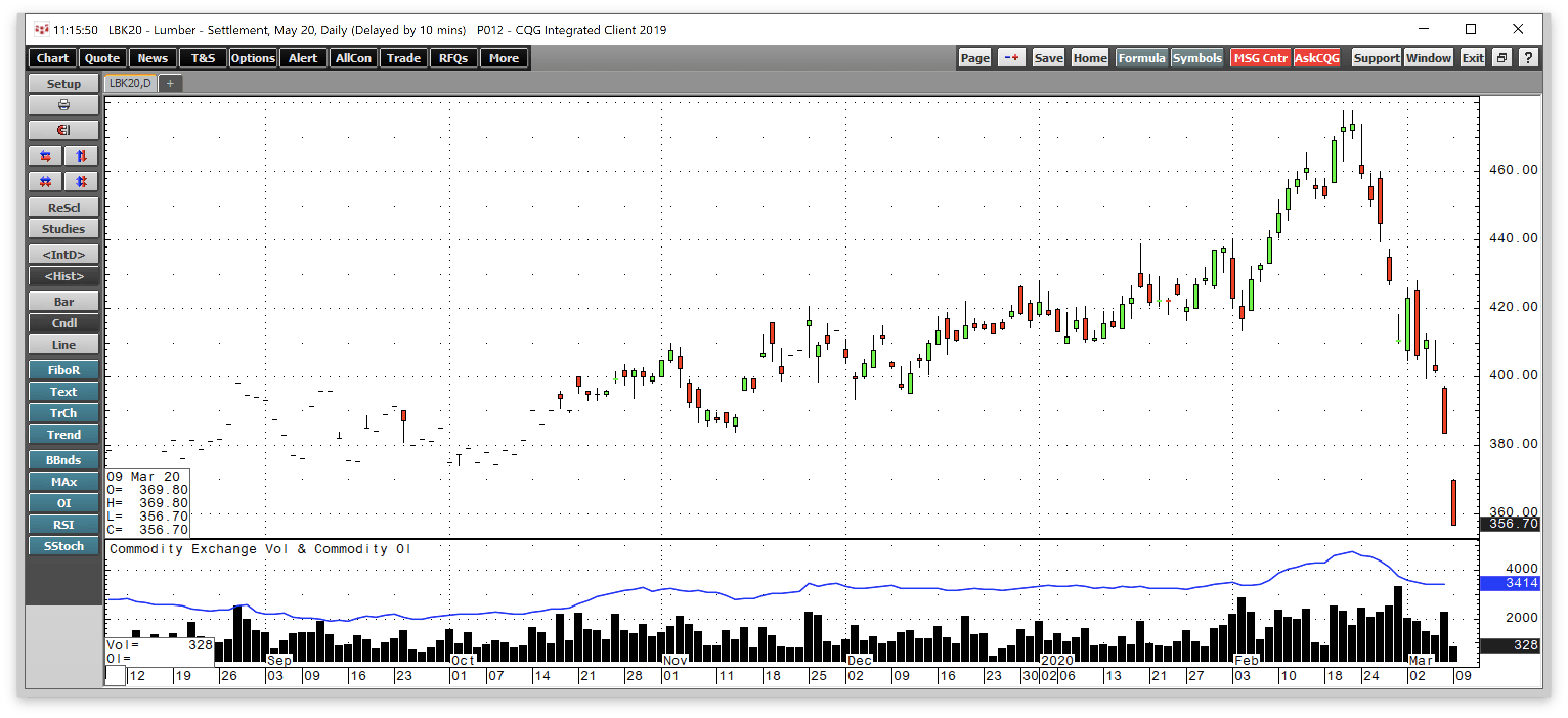

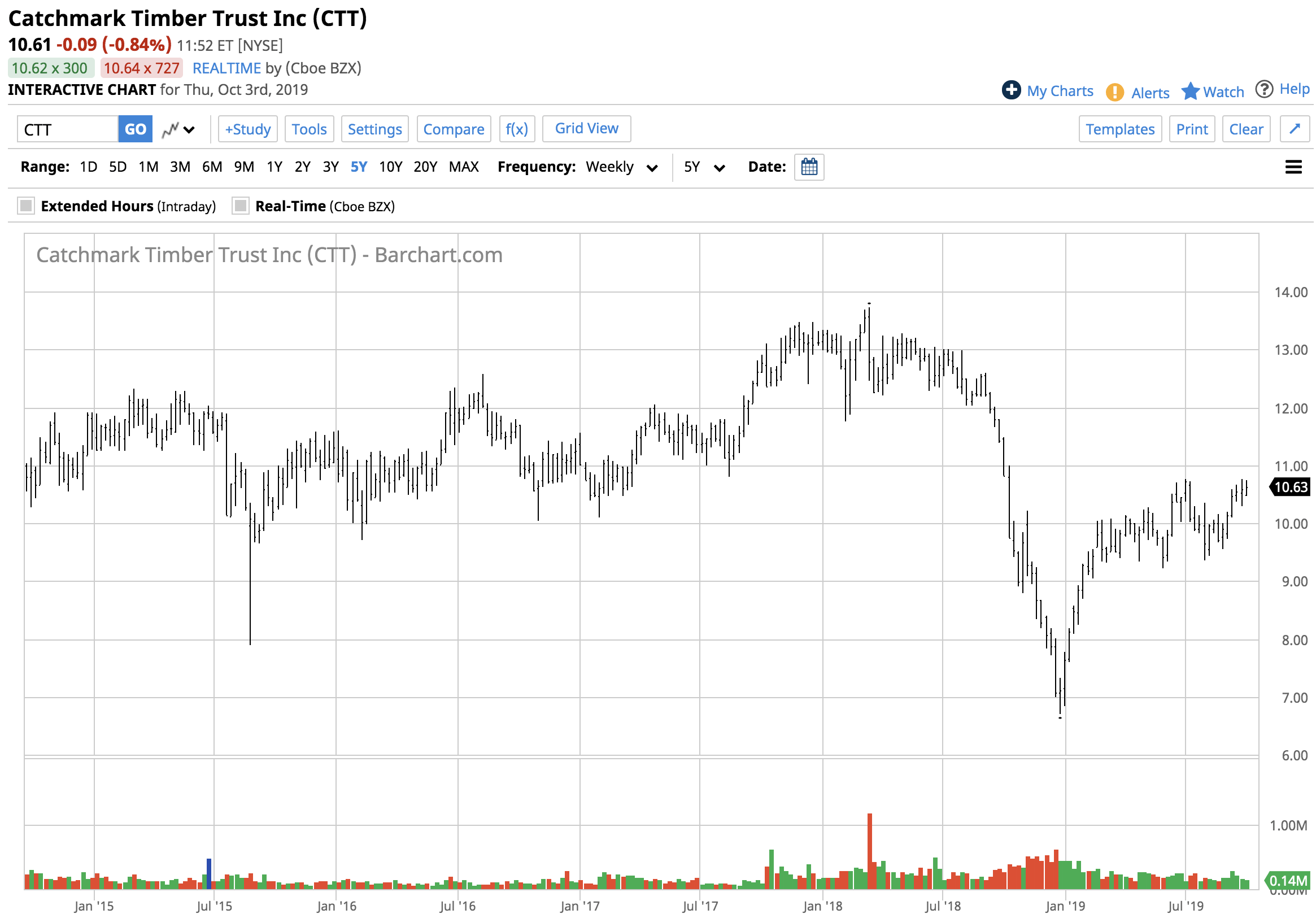

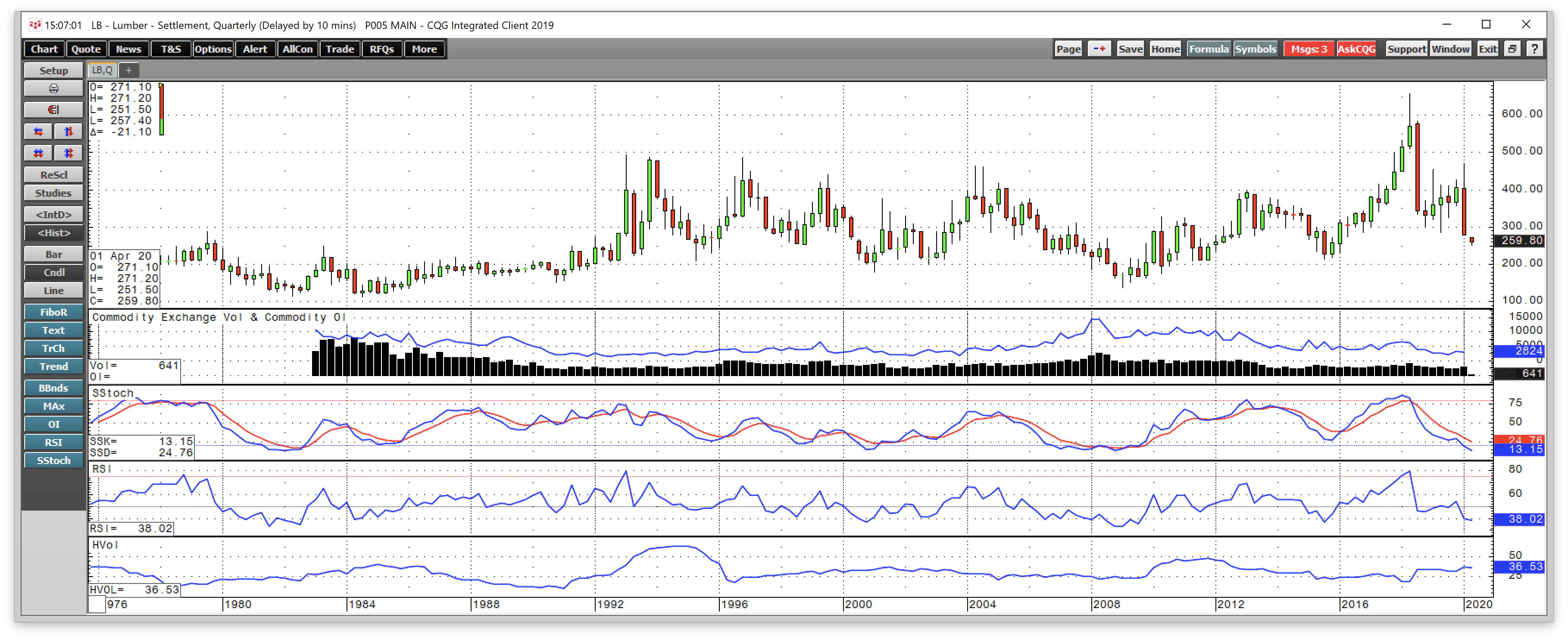

The long-awaited by me anyway ClaymoreClear Global Timber Index ETF CUT - Get Report is finally up and running. The metric calculations are based on US-listed Timber ETFs and every Timber ETF has one issuer. Lumber Futures The Chicago Mercantile Exchange CME offers a contract on Random Length Lumber Futures. CME Lumber futures were up 28 Friday trading around 3738 per thousand board feet. The WOOD ETF product follows the price of lumber In 2008 during the global financial crisis the price of lumber futures fell to a low of 13790 per 1000 board feet.

Lumber Futures Etf. The largest Timber ETF is the iShares Global Timber Forestry ETF WOOD with 31868M in assets. The long-awaited by me anyway ClaymoreClear Global Timber Index ETF CUT - Get Report is finally up and running. Find information for Random Length Lumber Futures Quotes provided by CME Group. The lumber futures contract traded at the CME calls for on-track mill delivery of random length 8-20 ft.

Lumber Looks Set To Rally Weyerhaeuser Is A Wooden Reit Nyse Wy Seeking Alpha From seekingalpha.com

Lumber Looks Set To Rally Weyerhaeuser Is A Wooden Reit Nyse Wy Seeking Alpha From seekingalpha.com

The commodity has a strong fundamental backdrop with supply set to stay quite scarce amid continued robust demand from the renovation and home markets. The largest Timber ETF is the iShares Global Timber Forestry ETF WOOD with 31868M in assets. Chicago lumber futures were trading above 900 per 1000 board feet in the second week of February a level not seen since September last year buoyed by a combination of robust real estate markets and builder-friendly winter weather. CME Lumber futures were up 28 Friday trading around 3738 per thousand board feet. The Underlying Index is comprised of approximately 25 of. This is the first exchange-traded fund that offers a pure play on lumber – or.

We dont expect these prices forever but what we are seeing is a bit of acceptance that maybe going forward the price level may be different than it has been in the past Chris Virostek finance chief at West Fraser.

1 more than triple its levels during its low in April. Lumber Futures The Chicago Mercantile Exchange CME offers a contract on Random Length Lumber Futures. The Fund seeks investment results that correspond generally to the price and yield performance of the SP Global Timber Forestry Index. The long-awaited by me anyway ClaymoreClear Global Timber Index ETF CUT - Get Report is finally up and running. We dont expect these prices forever but what we are seeing is a bit of acceptance that maybe going forward the price level may be different than it has been in the past Chris Virostek finance chief at West Fraser. A similar story is playing out among lumber ETFs which investors have largely ignored despite prices rising to records this month due to tightening supply and strong repair and renovation demand.

Source: tradingview.com

Source: tradingview.com

Lumber futures price quote with latest real-time prices charts financials latest news technical analysis and opinions. A similar story is playing out among lumber ETFs which investors have largely ignored despite prices rising to records this month due to tightening supply and strong repair and renovation demand. The underlying product is two-inch by four-inch lumber that is between eight and 20 feet long. Each contract represents 110000 board feet. The Fund seeks investment results that correspond generally to the price and yield performance of the SP Global Timber Forestry Index.

Source: seekingalpha.com

Source: seekingalpha.com

Find exchange traded funds ETFs whose sector aligns with the same commodity grouping as the symbol you are viewing. The metric calculations are based on US-listed Timber ETFs and every Timber ETF has one issuer. Analysis of these related ETFs and how they are trading may provide insight to this commodity. Nominal 2 x 4s. The Fund seeks investment results that correspond generally to the price and yield performance of the SP Global Timber Forestry Index.

Source: seekingalpha.com

Source: seekingalpha.com

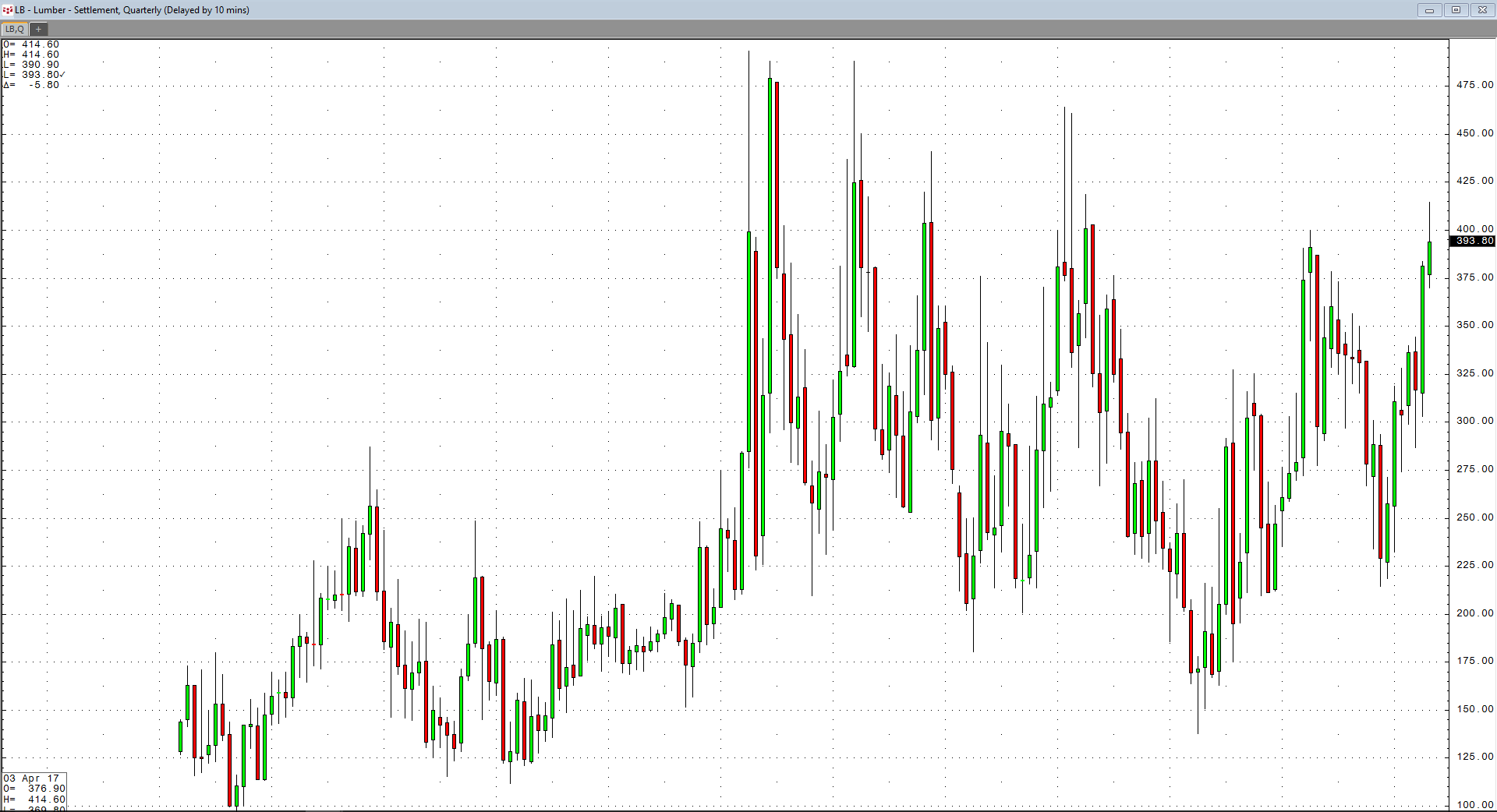

The price of lumber futures skyrocketed to a record high of 9285 per thousand board feet on Sept. Primarily the deliverable species is Western Spruce-Pine-Fir although other Western species - such as Hem-fir Englemann Spruce Alpine Fir and Lodgepole Pine - may also be delivered. The Fund seeks investment results that correspond generally to the price and yield performance of the SP Global Timber Forestry Index. Meanwhile lumber futures surged 47 over the past three weeks and was a few dollars short of records set in September. This is the first exchange-traded fund that offers a pure play on lumber – or.

Source: seekingalpha.com

Source: seekingalpha.com

The Fund seeks investment results that correspond generally to the price and yield performance of the SP Global Timber Forestry Index. Lumber Futures News Commodities Corner. Each contract represents 110000 board feet. Meanwhile lumber futures were trading around. CME Lumber futures were up 28 Friday trading around 3738 per thousand board feet.

Source: m.futuresmag.com

Source: m.futuresmag.com

The WOOD ETF product follows the price of lumber In 2008 during the global financial crisis the price of lumber futures fell to a low of 13790 per 1000 board feet. Chicago lumber futures were trading above 900 per 1000 board feet in the second week of February a level not seen since September last year buoyed by a combination of robust real estate markets and builder-friendly winter weather. The commodity has a strong fundamental backdrop with supply set to stay quite scarce amid continued robust demand from the renovation and home markets. We dont expect these prices forever but what we are seeing is a bit of acceptance that maybe going forward the price level may be different than it has been in the past Chris Virostek finance chief at West Fraser. WOOD increased 92 and Invesco MSCI Global Timber ETF CUT advanced 95.

Source: seekingalpha.com

Source: seekingalpha.com

Lumber starts the year on the wrong foot after a record year By MarketWatch - Jan 22 2021 Lumber prices more than doubled last year to touch a record high. Lumber Futures The Chicago Mercantile Exchange CME offers a contract on Random Length Lumber Futures. The WOOD ETF product follows the price of lumber In 2008 during the global financial crisis the price of lumber futures fell to a low of 13790 per 1000 board feet. The underlying product is two-inch by four-inch lumber that is between eight and 20 feet long. Meanwhile lumber futures surged 47 over the past three weeks and was a few dollars short of records set in September.

Source: seekingalpha.com

Source: seekingalpha.com

Get the latest Lumber price LBS as well as the latest futures prices and other commodity market news at Nasdaq. The commodity has a strong fundamental backdrop with supply set to stay quite scarce amid continued robust demand from the renovation and home markets. The most recent ETF. Find exchange traded funds ETFs whose sector aligns with the same commodity grouping as the symbol you are viewing. Find information for Random Length Lumber Futures Quotes provided by CME Group.

Source: seekingalpha.com

Source: seekingalpha.com

Each contract represents 110000 board feet. The Underlying Index is comprised of approximately 25 of. Nominal 2 x 4s. The commodity has a strong fundamental backdrop with supply set to stay quite scarce amid continued robust demand from the renovation and home markets. The largest Timber ETF is the iShares Global Timber Forestry ETF WOOD with 31868M in assets.

1 more than triple its levels during its low in April. In the last trailing year the best-performing Timber ETF was WOOD at 3113. WOOD increased 92 and Invesco MSCI Global Timber ETF CUT advanced 95. 1 more than triple its levels during its low in April. The lumber futures contract traded at the CME calls for on-track mill delivery of random length 8-20 ft.

Source: timelessinvestor.com

Source: timelessinvestor.com

The WOOD ETF product follows the price of lumber In 2008 during the global financial crisis the price of lumber futures fell to a low of 13790 per 1000 board feet. A similar story is playing out among lumber ETFs which investors have largely ignored despite prices rising to records this month due to tightening supply and strong repair and renovation demand. WOOD increased 92 and Invesco MSCI Global Timber ETF CUT advanced 95. Nominal 2 x 4s. Primarily the deliverable species is Western Spruce-Pine-Fir although other Western species - such as Hem-fir Englemann Spruce Alpine Fir and Lodgepole Pine - may also be delivered.

Source: seekingalpha.com

Source: seekingalpha.com

This is the first exchange-traded fund that offers a pure play on lumber – or. The most recent ETF. WOOD increased 92 and Invesco MSCI Global Timber ETF CUT advanced 95. CME Lumber futures were up 28 Friday trading around 3738 per thousand board feet. The underlying product is two-inch by four-inch lumber that is between eight and 20 feet long.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title lumber futures etf by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.